Our San Diego Home Insurance Diaries

Our San Diego Home Insurance Diaries

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Program

Value of Affordable Home Insurance

Protecting affordable home insurance is important for securing one's home and monetary well-being. Home insurance policy gives security against various threats such as fire, burglary, all-natural calamities, and personal liability. By having a comprehensive insurance strategy in position, house owners can feel confident that their most substantial investment is protected in the event of unexpected circumstances.

Inexpensive home insurance policy not only provides monetary security but likewise offers comfort (San Diego Home Insurance). When faced with climbing home values and building costs, having a cost-efficient insurance plan guarantees that house owners can quickly rebuild or repair their homes without dealing with considerable monetary worries

In addition, inexpensive home insurance policy can also cover individual valuables within the home, supplying reimbursement for products harmed or stolen. This protection extends past the physical structure of the home, securing the contents that make a house a home.

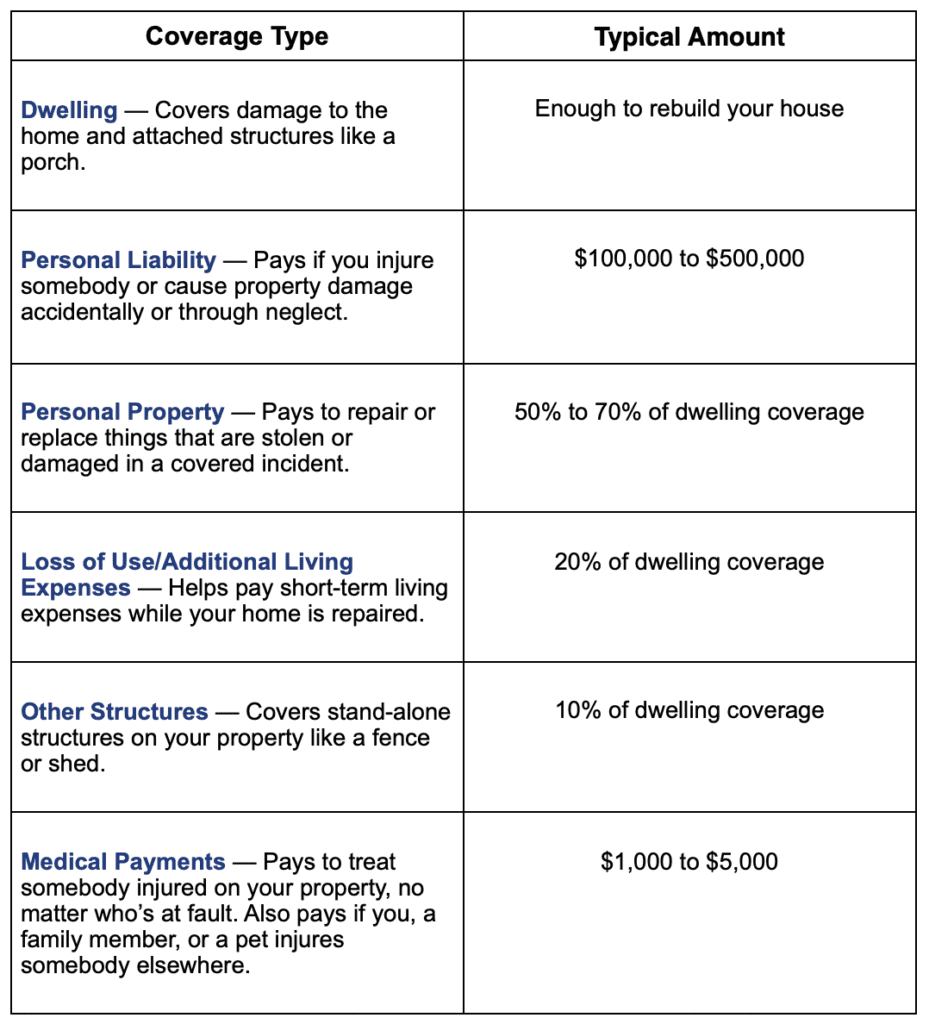

Insurance Coverage Options and Boundaries

When it involves insurance coverage restrictions, it's essential to comprehend the optimum amount your plan will certainly pay for each and every sort of insurance coverage. These restrictions can vary depending upon the policy and insurance firm, so it's important to assess them carefully to ensure you have sufficient security for your home and possessions. By comprehending the insurance coverage options and limits of your home insurance coverage, you can make informed choices to guard your home and enjoyed ones properly.

Variables Influencing Insurance Policy Prices

A number of variables dramatically affect the prices of home insurance plan. The place of your home plays a critical function in figuring out the insurance premium. Residences in locations susceptible to natural calamities or with high criminal activity rates generally have higher insurance coverage expenses due to raised threats. The age and condition of your home are also factors that insurance firms take into consideration. Older homes or residential or commercial properties in inadequate problem may be extra expensive to guarantee as they are much more susceptible to damages.

In addition, the type of coverage you pick straight impacts the price of your insurance plan. Opting for extra coverage choices such as flood insurance policy or earthquake insurance coverage will certainly increase your costs. Likewise, picking higher insurance coverage limits will cause greater costs. Your deductible amount can additionally affect your insurance coverage prices. A higher insurance deductible typically indicates reduced premiums, but you will certainly need to pay even more expense in the event of an insurance claim.

Furthermore, your credit history, asserts background, and the insurance provider you select can all affect the rate of your home insurance coverage. By taking into consideration these variables, you can make enlightened choices to help manage your insurance coverage sets you back successfully.

Contrasting Quotes and Providers

In addition to comparing quotes, it is essential to examine the online reputation and economic security of the insurance service providers. Search for client reviews, scores from independent firms, and any background of grievances or regulatory actions. A reputable insurance coverage provider must have an excellent record of quickly refining cases and giving superb client service.

Additionally, think about the specific insurance coverage attributes provided by each service provider. Some insurance providers might provide fringe benefits such as identification theft defense, devices breakdown insurance coverage, or coverage for high-value things. By meticulously contrasting quotes and suppliers, you can make an educated choice and select the home insurance plan that ideal meets your requirements.

Tips for Conserving on Home Insurance Coverage

After completely contrasting suppliers and quotes to find one of the most ideal coverage for your demands and budget plan, it is sensible to explore reliable strategies for minimizing home insurance. One of one of the most considerable means to save money on home insurance policy is by bundling your plans. Many insurance policy business offer price best site cuts if you purchase several policies from them, such as integrating your home and vehicle insurance. Enhancing your home's security procedures can additionally lead to cost savings. Mounting safety systems, smoke detectors, deadbolts, or an automatic sprinkler can decrease the threat of damages or theft, potentially reducing your insurance coverage costs. Furthermore, preserving an excellent credit history can positively impact your home insurance coverage rates. Insurance firms frequently consider debt background when determining costs, so paying costs on time and handling your credit responsibly can result in reduced insurance policy prices. Last but not least, regularly reviewing and updating your page plan to reflect any kind of modifications in your home or conditions can guarantee you are not spending for insurance coverage you no more requirement, assisting you save cash on your home insurance policy premiums.

Conclusion

In final thought, securing your home and liked ones with affordable home insurance is essential. Implementing tips for saving on home insurance policy can additionally aid you safeguard the essential security for your home without breaking the bank.

By deciphering the complexities of home insurance plans and discovering practical approaches for safeguarding affordable coverage, you can make certain that your home and liked ones are well-protected.

Home insurance coverage policies commonly supply numerous insurance coverage alternatives to secure your home and items - San Diego Home Insurance. By recognizing the protection options and restrictions of your article home insurance policy, you can make educated decisions to safeguard your home and loved ones effectively

Routinely assessing and upgrading your plan to reflect any adjustments in your home or scenarios can ensure you are not paying for insurance coverage you no longer need, assisting you save cash on your home insurance costs.

In conclusion, guarding your home and liked ones with budget-friendly home insurance policy is vital.

Report this page